Life Insurance in and around Chicago

Protection for those you care about

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

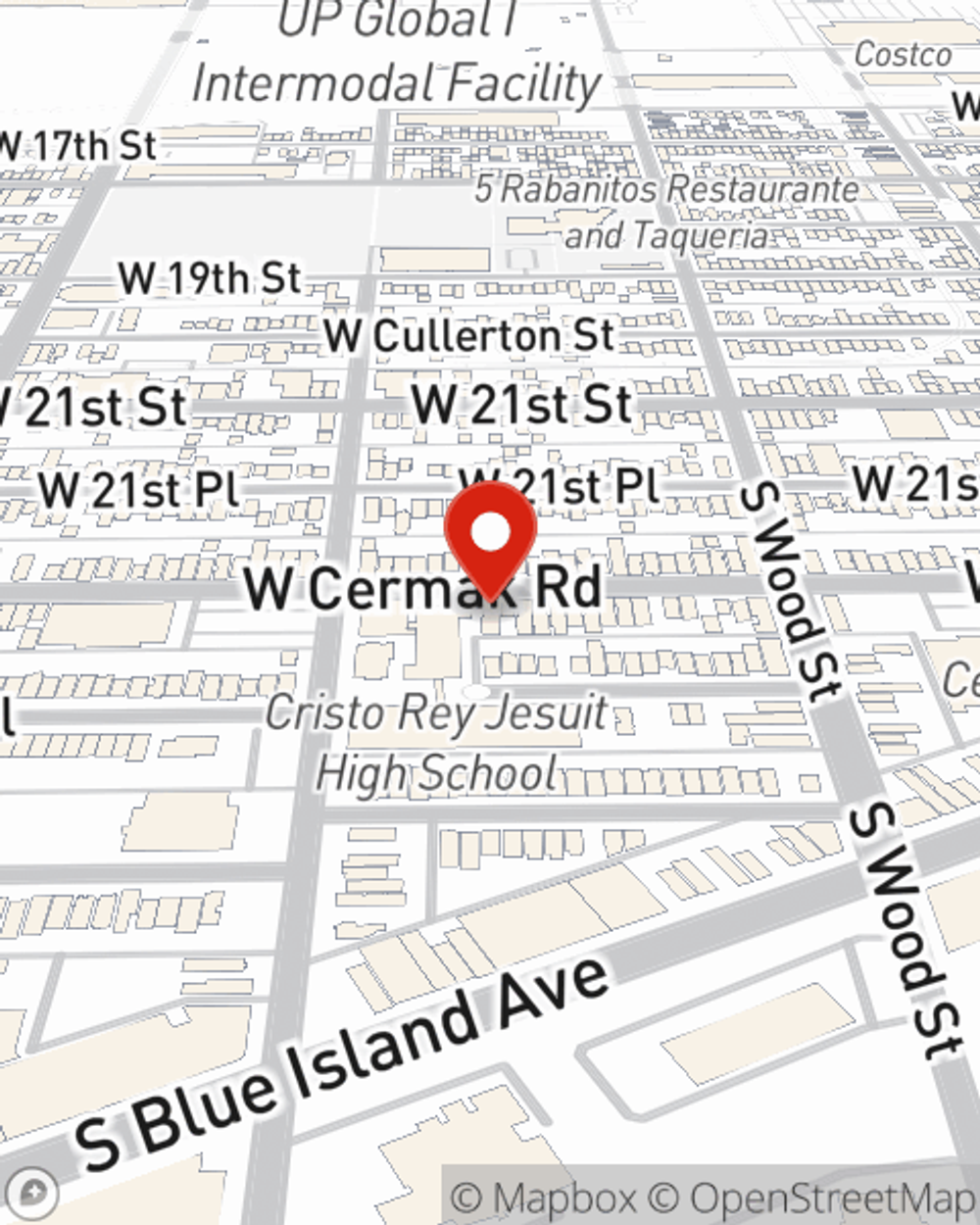

- Chicago

- Indiana

- Pilsen

- Little Village

- Back of the yards

- Gage park

- Garfield Ridge

- Ashburn

- West lawn

- Heart of Chicago

- West Loop

- Downtown Chicago

- Chinatown

- Andersonville

- Wrigleyville

- Scottsdale Park

- Hometown

- Logan Square

- Bucktown

- Hyde Park

- Englewood

- Canaryville

- Bridgeport

- Little Italy

It's Time To Think Life Insurance

There's a common misconception that you should wait until you're older to get Life insurance, but even if you are young and newly married, now could be the right time to start looking into Life insurance.

Protection for those you care about

Now is a good time to think about Life insurance

Life Insurance You Can Trust

Coverage from State Farm helps you rest easy knowing your loved ones will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the cost associated with financially supporting children, life insurance is a critical need for young families. Even for parents who stay home, the costs of substituting housekeeping or daycare can be sizeable. For those who aren't raising a family, you may be planning to have children someday or want the peace of knowing your funeral is covered.

Did you know that there's now a life insurance option available that's perfect for a person who thought they couldn't qualify? It's called Guaranteed Issue Final Expense and it can really come in handy when it comes to paying for final expenses like medical bills or funeral costs. Don't let these expenses be a burden on your loved ones in the future - check out State Farm Guaranteed Issue Final expense from State Farm agent Violeta Delgado for help with all your life insurance needs

Have More Questions About Life Insurance?

Call Violeta at (773) 254-5500 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Violeta Delgado

State Farm® Insurance AgentSimple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.